Effective finance management is crucial for achieving financial stability and growth. However, many individuals and businesses make common mistakes that can derail their financial goals. In this article, we’ll explore five common mistakes in finance management and how to avoid them.

1. Lack of Budgeting

The Mistake:

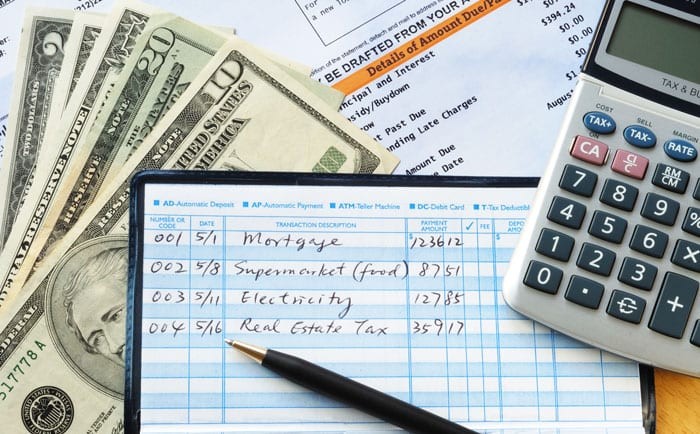

Many people fail to create a detailed budget, leading to overspending and financial stress. Without a budget, it’s easy to lose track of where your money is going.

How to Avoid It:

Create a comprehensive budget that outlines your income, expenses, and savings goals. Use budgeting tools or apps to track your spending and ensure you stay within your limits. Regularly review and adjust your budget as needed.

2. Ignoring Emergency Funds

The Mistake:

Not having an emergency fund can leave you vulnerable to unexpected expenses, such as medical bills or car repairs. Relying on credit cards or loans for emergencies can lead to debt accumulation.

How to Avoid It:

Set aside a portion of your income each month into an emergency fund. Aim to save at least three to six months’ worth of living expenses. This safety net will help you handle unexpected costs without jeopardizing your financial stability.

3. Overlooking Debt Management

The Mistake:

Accumulating high-interest debt, such as credit card balances, can quickly spiral out of control if not managed properly. Ignoring debt repayment can lead to increased interest charges and financial stress.

How to Avoid It:

Prioritize paying off high-interest debts first. Create a debt repayment plan and stick to it. Consider consolidating debts to secure a lower interest rate and streamline payments. Avoid taking on new debt unless absolutely necessary.

4. Neglecting Financial Goals

The Mistake:

Failing to set clear financial goals can result in aimless spending and a lack of direction in your financial planning. Without goals, it’s challenging to measure progress and stay motivated.

How to Avoid It:

Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. Whether it’s saving for a house, retirement, or a vacation, having clear goals will guide your financial decisions and keep you focused.

5. Not Investing for the Future

The Mistake:

Relying solely on savings accounts without considering investments can limit your financial growth. Inflation can erode the purchasing power of your savings over time.

How to Avoid It:

Educate yourself about different investment options, such as stocks, bonds, and mutual funds. Diversify your investment portfolio to spread risk. Start investing early to take advantage of compound interest and grow your wealth over time.

Conclusion

Avoiding these common finance management mistakes can significantly improve your financial health and help you achieve your long-term goals. By budgeting effectively, building an emergency fund, managing debt, setting clear goals, and investing wisely, you can create a solid foundation for financial success.