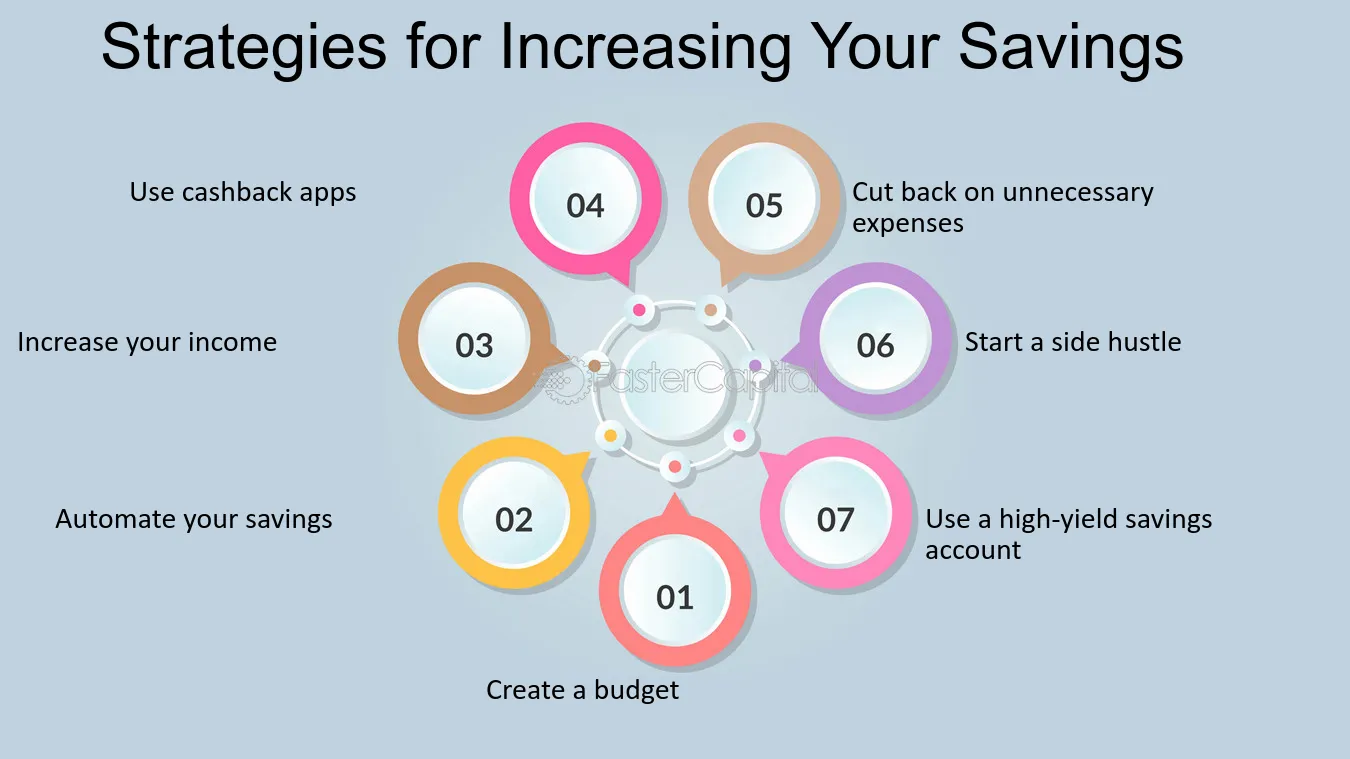

Increasing your savings rate is crucial for financial security and achieving your long-term goals. Whether you’re saving for an emergency fund, a down payment on a house, or retirement, these strategies can help you boost your savings rate effectively.

1. Track Your Expenses and Create a Budget

To increase your savings rate, start by tracking your expenses. Use budgeting apps or spreadsheets to monitor where your money is going. Once you have a clear picture of your spending habits, create a budget that prioritizes savings. Allocate a specific percentage of your income to savings each month and stick to it.

2. Automate Your Savings

Automating your savings is one of the easiest ways to increase your savings rate. Set up an automatic transfer from your checking account to your savings account on payday. By paying yourself first, you ensure that a portion of your income goes directly into savings before you have a chance to spend it.

3. Reduce Unnecessary Expenses

Cutting back on unnecessary expenses can significantly boost your savings rate. Review your monthly expenses and identify areas where you can reduce spending, such as dining out, subscription services, or impulse purchases. Redirect the money saved from these cutbacks directly into your savings account.

4. Increase Your Income

Another effective way to increase your savings rate is by boosting your income. Consider taking on a side hustle, freelancing, or asking for a raise at work. The additional income can be funneled directly into your savings, accelerating your financial progress.

5. Set Clear Financial Goals

Setting specific financial goals can motivate you to save more. Whether it’s saving for a vacation, a new car, or retirement, having a clear goal helps you stay focused. Break down your goal into smaller, manageable targets, and track your progress regularly to stay on course.

6. Avoid Lifestyle Inflation

As your income increases, it’s tempting to spend more on luxuries and non-essential items. Avoid lifestyle inflation by keeping your spending in check, even as you earn more. Instead, increase your savings rate with any extra income, which will help you reach your financial goals faster.

7. Use High-Interest Savings Accounts

Maximize your savings by using high-interest savings accounts. These accounts offer better interest rates than traditional savings accounts, allowing your money to grow faster over time. Compare different banks and online financial institutions to find the best rates.

Conclusion

Increasing your savings rate requires discipline, planning, and smart financial choices. By tracking your expenses, automating savings, reducing unnecessary costs, and maximizing income opportunities, you can significantly boost your savings rate and achieve financial stability. Start implementing these strategies today to take control of your financial future.