Understanding High-Risk Countries in the Banking Sector

If you’re planning to travel to or do business in a high-risk country, particularly in the banking sector, it’s crucial to be aware of the unique challenges and risks involved. High-risk countries are often identified due to significant deficiencies in their anti-money laundering (AML) and counter-terrorism financing (CTF) measures, as well as high levels of corruption and political instability. Here’s what you need to keep in mind.

1. Recognize the Definition of High-Risk Countries

Identifying High-Risk Jurisdictions

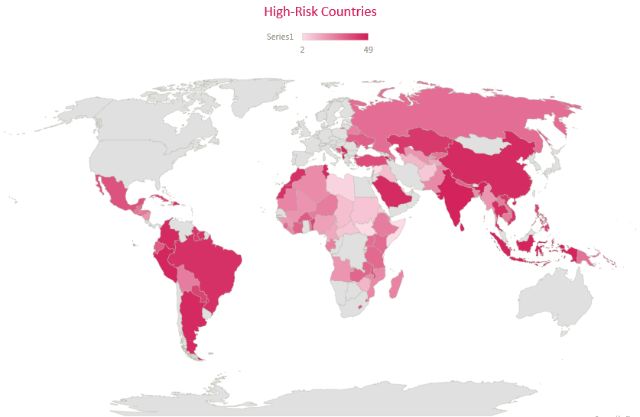

High-risk countries are typically defined by international organizations such as the Financial Action Task Force (FATF), which lists jurisdictions with strategic deficiencies in their AML/CFT frameworks. Countries like Iran, North Korea, and Myanmar frequently appear on these lists due to ongoing issues related to financial crimes and corruption.

2. Understand the Implications for Banking Transactions

Increased Scrutiny on Financial Activities

When engaging with banks or financial institutions in high-risk countries, expect heightened scrutiny. Transactions may be subject to additional verification processes, and banks may require extensive documentation to comply with international regulations. This can lead to delays and complications in accessing financial services.

3. Be Aware of Potential Scams and Fraud

Protecting Yourself from Financial Fraud

High-risk environments often attract fraudulent schemes targeting unsuspecting tourists or businesses. Be vigilant about offers that seem too good to be true, and always verify the legitimacy of financial institutions before engaging in transactions. Research local laws and regulations regarding banking practices to avoid potential pitfalls.

4. Know Your Rights and Local Laws

Familiarize Yourself with Legal Frameworks

Understanding your rights as a foreigner in a high-risk country is essential. Familiarize yourself with local laws related to banking, finance, and consumer protection. This knowledge can help you navigate potential legal issues more effectively and protect your interests while abroad.

5. Implement Robust Risk Management Strategies

Mitigating Financial Risks

If you must conduct business in a high-risk country, develop a comprehensive risk management strategy. This includes conducting thorough due diligence on potential partners, understanding the local economic landscape, and being prepared for potential disruptions due to political or economic instability.

6. Utilize Secure Payment Methods

Choosing Safe Transaction Options

When making transactions, opt for secure payment methods that offer protection against fraud. Avoid carrying large sums of cash and consider using internationally recognized payment platforms that provide additional security features.

7. Stay Informed About Current Events

Monitoring Political and Economic Developments

Keeping abreast of current events in high-risk countries is crucial for anticipating changes that may affect your safety or financial dealings. Political unrest, changes in government policies, or economic downturns can significantly impact your experience.

8. Seek Local Expertise

Consulting with Professionals

Consider working with local experts who understand the financial landscape of high-risk countries. Local consultants can provide valuable insights into navigating regulatory requirements, cultural nuances, and potential risks associated with doing business.

9. Maintain Open Communication with Your Bank

Establishing Clear Lines of Communication

Before traveling or conducting business, maintain open communication with your bank regarding your plans. Inform them of your travel itinerary and any transactions you anticipate making to avoid complications related to fraud alerts or account freezes.

10. Prioritize Personal Safety

Ensuring Your Well-Being While Abroad

Above all, prioritize your personal safety when traveling to high-risk countries. Stay informed about local conditions, avoid risky areas, and have a plan for emergencies. Registering with your embassy can provide an added layer of security while abroad.

Proceed with Caution in High-Risk Countries

Traveling or conducting business in high-risk countries presents unique challenges that require careful consideration and preparation. By understanding the implications of operating within these jurisdictions and implementing effective risk management strategies, you can navigate the complexities of the banking sector while safeguarding your interests. Always stay informed, remain vigilant, and prioritize your safety for a successful experience abroad!