Understanding How Credit Card Refunds Work

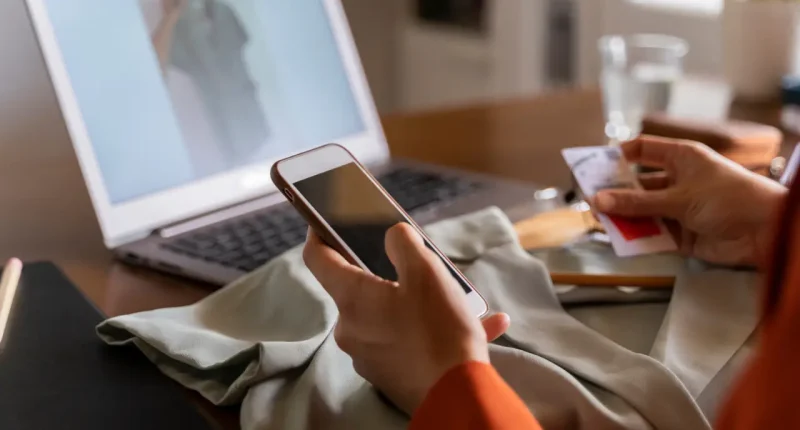

Credit card refunds are a common part of the consumer experience, allowing you to receive money back for purchases made with your card. When you return an item or cancel a service, the merchant initiates the refund process, which involves sending the refund amount back to your credit card issuer. This process ensures that your account balance reflects the refund accurately.

The Refund Process Explained

When you request a refund, the merchant processes it through their payment processor, which then communicates with your credit card issuer. The amount of your original purchase is credited back to your account. It’s important to note that refunds typically take between 5 to 14 business days to appear on your statement, depending on the merchant and your card issuer’s policies. Understanding this timeline can help manage expectations when waiting for your funds to be returned.

Typical Costs and Fees Associated with Refunds

Are There Any Fees for Refunds?

Most credit card issuers do not charge fees for processing refunds; however, it’s essential to read the terms and conditions of your specific card agreement. In some cases, if you request a cash refund instead of a credit back to your card, it may be treated as a cash advance, which could incur additional fees and interest charges. Always clarify with the merchant how they handle refunds to avoid unexpected costs.

Impact on Your Credit Card Balance

When you receive a refund, it reduces your outstanding balance or increases your available credit limit. This can be particularly beneficial if you’ve made a large purchase and need to manage your finances carefully. Keeping track of refunds can help maintain a healthy credit utilization ratio, which is an important factor in determining your credit score.

Common Scenarios for Requesting Refunds

Returning Items: What You Should Know

Returning items is the most common reason for requesting a credit card refund. Before making a return, familiarize yourself with the merchant’s return policy, as it can vary significantly between retailers. Some stores may offer store credit instead of a cash refund, while others might have specific time frames within which returns must be made.

Handling Disputes and Chargebacks

If you encounter issues with a merchant refusing to issue a refund or if you receive an incorrect item, you may need to file a chargeback with your credit card issuer. A chargeback allows you to dispute a transaction and request a refund even if the merchant does not comply. This process can take longer than standard refunds—up to 90 days—but it provides an essential avenue for protecting consumers from fraud and unfair practices.

Tips for Smooth Refund Experiences

Keep Documentation Handy

To ensure a smooth refund process, always keep receipts and any correspondence related to your purchase. Documenting these details can be invaluable if you need to dispute a charge or follow up on a delayed refund.

Communicate Clearly with Merchants

When requesting a refund, communicate clearly with the merchant about your reasons for returning the item or canceling the service. Providing detailed information can expedite the process and help resolve any misunderstandings quickly.

Navigating Credit Card Refunds with Confidence

Understanding how credit card refunds work is crucial for every consumer. By familiarizing yourself with the process, potential costs, and best practices for requesting refunds, you can navigate this aspect of financial management more effectively. Whether you’re returning an item or disputing a charge, being informed empowers you to protect your finances and make smarter purchasing decisions.