Seamless Cross-Chain Transactions

Bridging Blockchain Networks

In 2025, blockchain interoperability is revolutionizing global payments by enabling seamless communication between disparate blockchain networks. Protocols like Polkadot and Cosmos allow different blockchains to share data and value, eliminating silos that once slowed transactions. This connectivity enables faster, cheaper cross-border payments, bypassing traditional intermediaries like banks. For businesses and consumers, interoperability means instant transfers across currencies and platforms, enhancing efficiency and reducing costs in a globalized economy.

Enhancing Payment Speed and Cost

Streamlining Financial Operations

Interoperability tackles the inefficiencies of traditional payment systems, where cross-border transactions can take days and incur high fees. By connecting blockchains, interoperable systems enable near-instant settlements, even for complex international transfers. For instance, a retailer in Asia can pay a supplier in Europe using stablecoins on different networks, with transactions cleared in seconds. This speed and cost-effectiveness are transforming global trade, making blockchain-based payments a preferred choice for businesses seeking agility in 2025.

Strengthening Compliance Through Transparency

Unified Standards for Regulation

Blockchain interoperability is also reshaping compliance by creating transparent, traceable systems for global financial regulations. Interoperable networks allow regulators to access standardized data across blockchains, simplifying anti-money laundering (AML) and know-your-customer (KYC) processes. Smart contracts automate compliance checks, ensuring transactions meet local laws without manual intervention. This unified approach reduces regulatory friction, enabling businesses to operate confidently across jurisdictions while maintaining trust with authorities.

Empowering Decentralized Finance

Expanding DeFi’s Reach

The rise of decentralized finance (DeFi) is amplified by blockchain interoperability, which connects DeFi platforms across multiple chains. Users can access lending, borrowing, or trading services on Ethereum, Binance Smart Chain, or Solana through a single interface, maximizing liquidity and choice. In 2025, this integration drives financial inclusion, allowing underserved populations to participate in global markets. Interoperability ensures DeFi’s scalability, making it a cornerstone of modern finance for both individuals and institutions.

Reducing Fragmentation Risks

Building a Cohesive Ecosystem

Fragmentation has long hindered blockchain adoption, with isolated networks limiting scalability and user access. Interoperability addresses this by creating a cohesive ecosystem where assets and data flow freely. For example, a tokenized asset on one blockchain can be used as collateral on another, enhancing flexibility for financial institutions. This interconnected framework reduces the risk of market fragmentation, fostering collaboration among blockchain developers and driving innovation in payment solutions.

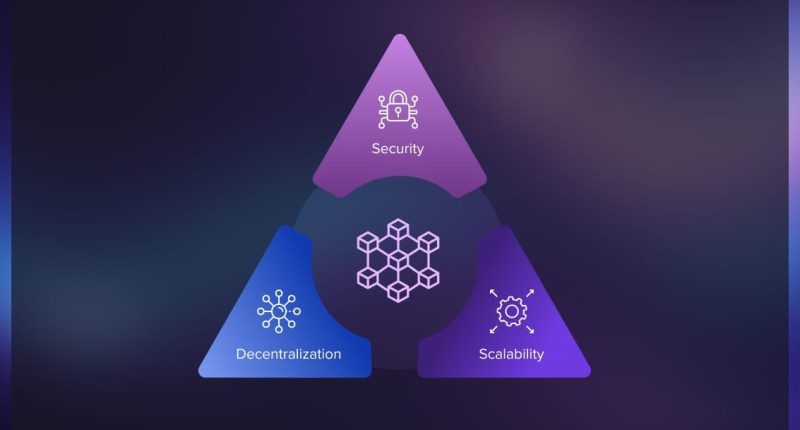

Challenges and Future Outlook

Navigating Technical and Regulatory Hurdles

Despite its promise, blockchain interoperability faces challenges, including technical complexities and evolving regulatory landscapes. Ensuring secure data transfers across chains requires robust protocols to prevent hacks or errors. Additionally, harmonizing compliance across jurisdictions remains a hurdle, as global standards are still developing. However, advancements in cross-chain bridges and collaborative governance models are paving the way for a future where interoperable blockchains power seamless, compliant global payments, transforming finance in 2025 and beyond.