Investing wisely for long-term growth is key to building wealth and securing your financial future. Whether you’re a seasoned investor or just starting out, understanding the fundamentals of long-term investing can help you make informed decisions that align with your financial goals. Here’s a comprehensive guide on how to invest wisely for long-term growth, with SEO-optimized tips to enhance your financial strategy.

1. Set Clear Financial Goals

Before you start investing, it’s crucial to define your financial goals. Are you saving for retirement, a child’s education, or a down payment on a house? Knowing your objectives will help you choose the right investment strategy and time horizon. Long-term growth typically involves a timeline of five years or more, which allows your investments to compound and grow over time.

2. Understand Your Risk Tolerance

Investing always involves risk, and understanding your risk tolerance is essential for making wise investment choices. Your risk tolerance depends on factors like your age, financial situation, and comfort level with market fluctuations. Higher-risk investments, like stocks, offer greater potential for long-term growth but come with increased volatility. Conversely, bonds are lower-risk but provide more modest returns.

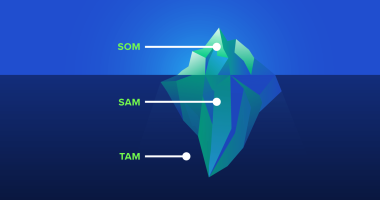

3. Diversify Your Portfolio

Diversification is a key principle of wise investing. By spreading your investments across different asset classes—such as stocks, bonds, real estate, and mutual funds—you can reduce the risk of significant losses. A diversified portfolio can help balance potential gains and losses, ensuring more consistent growth over the long term.

4. Focus on Low-Cost Index Funds and ETFs

For long-term growth, low-cost index funds and exchange-traded funds (ETFs) are excellent options. These funds track the performance of a market index, such as the S&P 500, and offer broad market exposure at a low cost. Over time, index funds and ETFs have consistently outperformed most actively managed funds, making them a popular choice for long-term investors.

5. Invest in Growth Stocks

Growth stocks are shares in companies that are expected to grow at an above-average rate compared to other companies. While they can be more volatile than value stocks, they offer significant potential for long-term gains. Focus on industries with strong growth potential, such as technology, healthcare, and renewable energy.

6. Reinvest Dividends

Reinvesting dividends is a powerful way to boost your long-term growth. Instead of taking dividend payments as cash, reinvest them to purchase more shares of the stock or fund. This compounding effect can significantly increase your investment returns over time, as your dividends generate more dividends in the future.

7. Stay Consistent with Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves regularly investing a fixed amount of money, regardless of market conditions. This approach reduces the impact of market volatility on your investments by spreading out purchases over time. It ensures that you buy more shares when prices are low and fewer when prices are high, ultimately lowering your average cost per share.

8. Avoid Timing the Market

Trying to time the market—buying low and selling high—can be tempting, but it’s notoriously difficult and risky. Even experienced investors struggle to predict market movements accurately. Instead of timing the market, focus on a long-term strategy by staying invested through market fluctuations. This approach has historically yielded better results for long-term growth.

9. Regularly Review and Rebalance Your Portfolio

As your investments grow, it’s essential to regularly review and rebalance your portfolio to maintain your desired asset allocation. Rebalancing involves selling assets that have increased in value and buying more of those that have decreased, ensuring your portfolio stays aligned with your risk tolerance and financial goals.

10. Stay Informed and Adapt to Market Changes

The financial markets are constantly evolving, and staying informed about economic trends, market news, and changes in the global economy is crucial. Keep learning about investing, seek advice from financial experts, and be prepared to adjust your strategy as needed to ensure long-term growth.

Conclusion

Investing wisely for long-term growth requires patience, discipline, and a well-thought-out strategy. By setting clear financial goals, understanding your risk tolerance, diversifying your portfolio, and focusing on low-cost investments, you can build a robust investment portfolio that grows steadily over time. Remember, the key to long-term success is consistency and staying informed, ensuring that your investments continue to align with your financial goals.