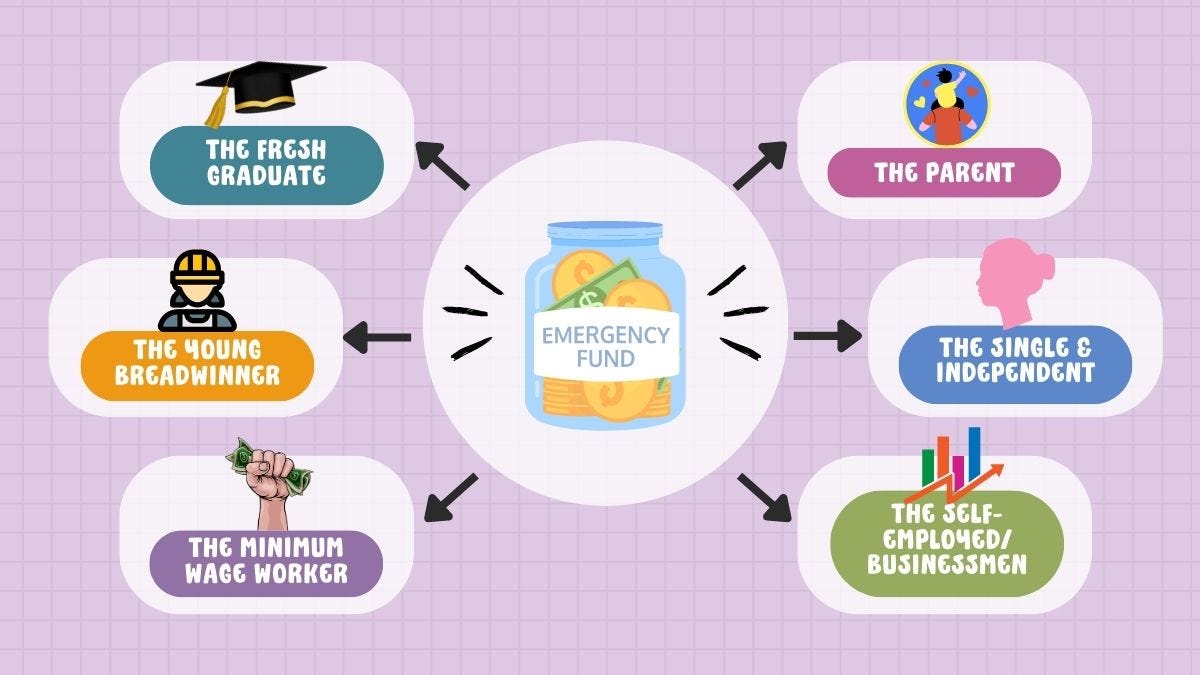

Building an emergency fund is a crucial step towards achieving financial security. An emergency fund acts as a financial safety net, providing you with the resources to handle unexpected expenses without resorting to debt. Whether it’s a medical emergency, car repair, or job loss, having a well-funded emergency account can give you peace of mind and protect your long-term financial health. Here’s how to build an emergency fund successfully, with SEO-focused tips to enhance your financial strategy.

1. Set a Clear Savings Goal

The first step in building an emergency fund is to set a clear savings goal. Financial experts recommend saving three to six months’ worth of living expenses. This amount should cover essential costs like rent or mortgage payments, utilities, groceries, and insurance. To determine your goal, calculate your average monthly expenses and multiply by three to six, depending on your comfort level.

2. Create a Dedicated Emergency Fund Account

To successfully build an emergency fund, it’s important to keep your savings separate from your regular checking account. Open a dedicated high-yield savings account specifically for your emergency fund. This not only helps you earn interest but also reduces the temptation to dip into your savings for non-emergency expenses.

3. Automate Your Savings

One of the easiest ways to build an emergency fund is to automate your savings. Set up automatic transfers from your checking account to your emergency fund account on payday. This ensures that a portion of your income is consistently allocated to your savings without requiring manual action, making it easier to grow your fund over time.

4. Start Small and Gradually Increase Contributions

If saving three to six months of expenses seems daunting, start small. Begin by saving a smaller, more achievable amount, like $500 or $1,000. Once you reach this initial milestone, gradually increase your contributions as your financial situation allows. The key is consistency, even if you start with small amounts.

5. Reduce Unnecessary Expenses

To accelerate the growth of your emergency fund, identify and reduce unnecessary expenses in your budget. Cut back on discretionary spending, such as dining out, subscriptions, or impulse purchases, and redirect those funds into your emergency savings. Every dollar saved is a step closer to your goal.

6. Boost Your Income

In addition to reducing expenses, consider ways to boost your income to build your emergency fund faster. This could involve taking on a side job, freelancing, selling unused items, or asking for a raise. Any extra income can be directly deposited into your emergency fund account.

7. Reevaluate and Adjust Your Savings Plan

Periodically review your emergency fund and savings strategy. Life circumstances change, and your savings goals may need adjustments. For example, if your expenses increase, you may need to save more. Conversely, if you’ve hit your savings target, consider redirecting funds to other financial goals, such as investing or paying off debt.

8. Avoid Using the Fund for Non-Emergencies

An emergency fund should only be used for true emergencies. It’s important to resist the temptation to dip into your savings for non-essential purchases or expenses. Maintain discipline and use your fund only for unforeseen, urgent situations.

9. Replenish Your Fund After Use

If you do need to use your emergency fund, make it a priority to replenish it as soon as possible. Resume your automated savings plan or increase your contributions temporarily until you’ve restored the fund to its target level.

10. Stay Committed to Your Savings Plan

Building an emergency fund requires commitment and discipline. Stay focused on your goal, even if it takes time to reach your target. Celebrate milestones along the way and remind yourself of the financial security you’re creating.

Conclusion

Building an emergency fund is a crucial step toward financial security and stress-free money management. By setting a clear goal, automating your savings, reducing unnecessary expenses, and staying committed, you can successfully build and maintain a robust emergency fund. This financial safety net will provide peace of mind and protect you from unexpected financial hardships, ensuring you’re prepared for whatever life throws your way.