Financial success is a goal many aspire to, yet achieving it requires more than just earning a high income. Effective financial management is crucial for turning income into wealth, ensuring financial stability, and securing a prosperous future. This guide will explore key strategies for achieving financial success through effective financial management.

1. Create a Budget and Stick to It

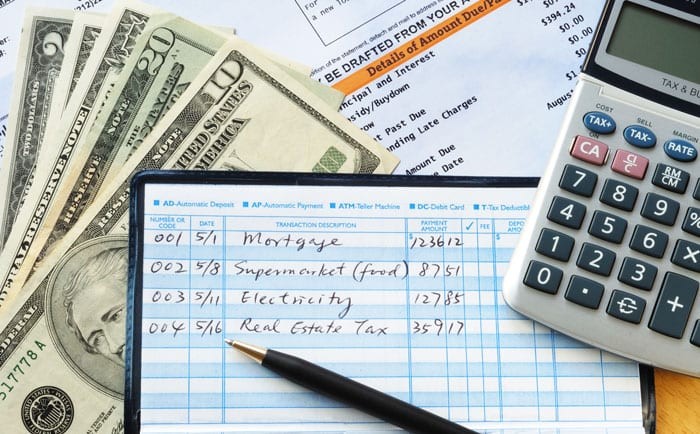

A well-planned budget is the cornerstone of financial management. It allows you to track your income and expenses, ensuring you live within your means. Start by listing all sources of income and all monthly expenses. Categorize your spending into essentials (like rent, utilities, and groceries) and non-essentials (like entertainment and dining out). Regularly review your budget to make adjustments and stay on track.

2. Build an Emergency Fund

An emergency fund is essential for financial stability. Aim to save three to six months’ worth of living expenses. This fund will provide a financial cushion in case of unexpected expenses, such as medical emergencies or job loss. Keeping this money in a separate, easily accessible savings account ensures you have a safety net when you need it most.

3. Manage Debt Wisely

Debt can be a major obstacle to financial success if not managed properly. Prioritize paying off high-interest debts first, such as credit card balances. Consider consolidating or refinancing loans to secure lower interest rates. Establish a payment plan and stick to it, avoiding accumulating new debt whenever possible.

4. Invest for the Future

Investing is a powerful tool for building wealth over time. Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to minimize risk. Consider working with a financial advisor to develop a personalized investment strategy that aligns with your long-term goals and risk tolerance.

5. Save for Retirement

Planning for retirement is a critical component of financial management. Contribute regularly to retirement accounts like 401(k)s or IRAs. Take advantage of employer matching contributions if available. The earlier you start saving for retirement, the more time your investments have to grow through compound interest.

6. Monitor and Adjust Financial Goals

Set clear financial goals, both short-term and long-term. Regularly monitor your progress and adjust your plans as needed. Life circumstances and financial markets change, so flexibility is key. Review your goals annually to ensure they remain relevant and achievable.

7. Educate Yourself on Financial Matters

Financial literacy is essential for effective financial management. Take the time to educate yourself on personal finance topics such as budgeting, investing, and tax planning. Numerous online resources, courses, and books are available to help you enhance your financial knowledge.

8. Seek Professional Advice

Sometimes, professional guidance is necessary to achieve financial success. Financial advisors can provide personalized advice tailored to your specific situation. They can help with investment strategies, retirement planning, tax optimization, and more. Choose a reputable advisor with a fiduciary duty to act in your best interest.

Conclusion

Achieving financial success through effective management requires discipline, knowledge, and proactive planning. By creating a budget, building an emergency fund, managing debt, investing wisely, saving for retirement, monitoring financial goals, educating yourself, and seeking professional advice, you can secure your financial future and enjoy long-term prosperity. Start implementing these strategies today to take control of your finances and achieve financial success.