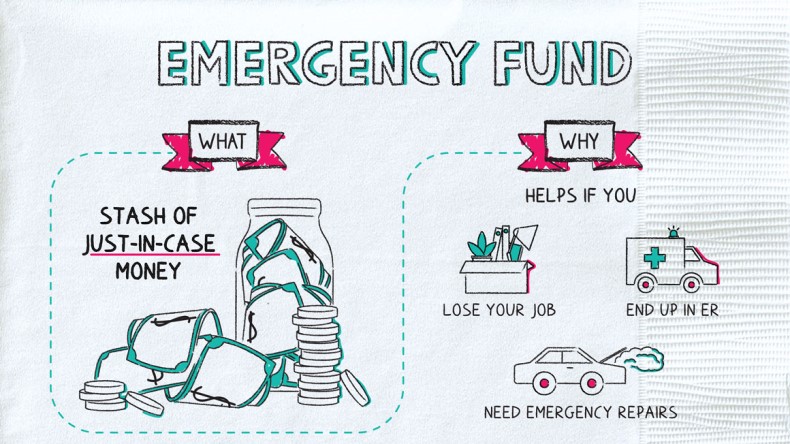

An emergency fund is a financial safety net designed to cover unexpected expenses and financial emergencies. It is one of the most crucial aspects of personal finance management, providing peace of mind and financial security in times of crisis. Let’s explore the key reasons why having an emergency fund is so important for your financial well-being.

1. Protection Against Unexpected Expenses

Life is full of surprises, and unexpected expenses can arise at any time—whether it’s a medical emergency, car repair, or home maintenance issue. An emergency fund helps you cover these costs without disrupting your regular budget or resorting to high-interest debt, like credit cards or payday loans.

2. Prevents Accumulating Debt

Without an emergency fund, you might have to rely on credit cards or loans to manage sudden financial demands. This can lead to accumulating debt and paying high-interest rates over time. An emergency fund provides the cash you need to handle emergencies without borrowing, helping you stay out of debt and maintain a healthy credit score.

3. Offers Financial Stability During Job Loss

Job loss can happen to anyone, often without warning. An emergency fund serves as a financial buffer, allowing you to cover your essential expenses, such as rent or mortgage payments, utilities, and groceries, while you search for new employment. This fund can provide enough time to find a job that suits your skills without the pressure of immediate financial stress.

4. Reduces Financial Stress and Anxiety

Knowing you have an emergency fund can significantly reduce stress and anxiety related to financial uncertainty. The peace of mind that comes with knowing you are prepared for unexpected events allows you to focus on other aspects of your life, like career growth, family, and personal development.

5. Helps You Stay on Track with Financial Goals

An emergency fund ensures that unexpected expenses do not derail your long-term financial goals, such as saving for retirement, buying a home, or investing in education. Instead of dipping into your savings or liquidating investments to cover emergencies, you can rely on your emergency fund to stay on course with your financial planning.

6. Supports Financial Independence

Having an emergency fund supports your financial independence by reducing your reliance on others during tough times. It empowers you to handle financial setbacks on your own, enhancing your ability to make independent financial decisions without compromising your financial health.

How Much Should You Save in an Emergency Fund?

A general rule of thumb is to save at least three to six months’ worth of living expenses in your emergency fund. This amount provides a sufficient cushion to cover essential costs, like housing, utilities, groceries, and healthcare, during an emergency. If you have dependents or variable income, you may want to aim for a larger fund of six to twelve months of expenses.

Conclusion

The importance of an emergency fund cannot be overstated. It provides protection against unexpected expenses, helps you avoid debt, offers stability during job loss, and reduces financial stress. By building and maintaining an emergency fund, you secure your financial future and enhance your ability to achieve long-term financial goals.