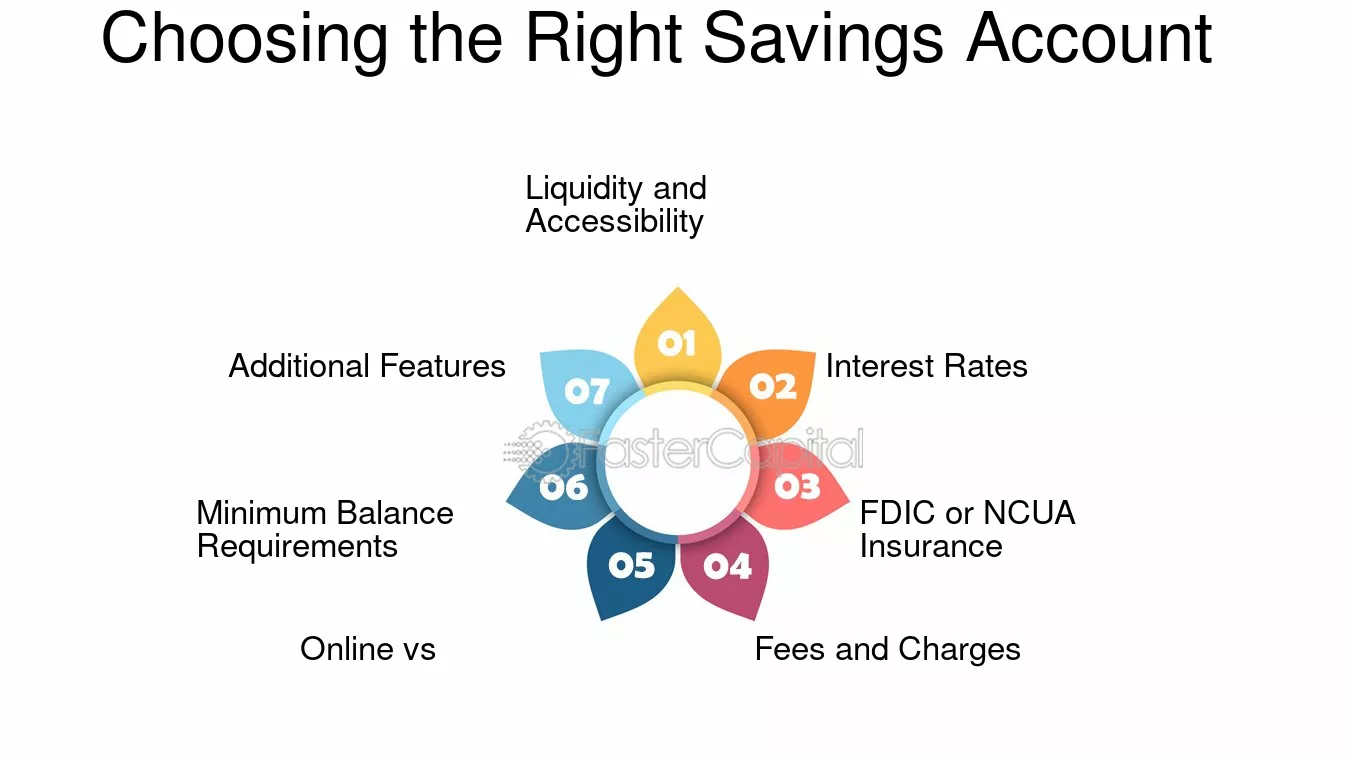

Choosing the right savings account is an essential step in managing your personal finances effectively. A well-selected savings account not only keeps your money safe but also helps it grow through interest. With so many options available, understanding how to pick the right savings account can seem overwhelming. Here are some key factors to consider when selecting the best savings account for your financial needs.

1. Interest Rates

One of the most critical factors to consider when choosing a savings account is the interest rate. A higher interest rate means your money will grow faster over time. Look for a savings account with a competitive interest rate to maximize your returns. Remember that some accounts offer introductory rates that may decrease after a certain period, so it’s essential to understand the long-term rate you will receive.

2. Fees and Charges

Pay attention to any fees associated with the savings account. Common fees include monthly maintenance fees, ATM fees, and penalties for exceeding withdrawal limits. Opt for an account with minimal or no fees to avoid unnecessary costs that could erode your savings over time. Some banks may waive fees if you meet specific requirements, like maintaining a minimum balance.

3. Accessibility and Convenience

Consider how easily you can access your money. If you want the flexibility to withdraw funds or manage your account online, look for a bank that offers digital banking services, such as mobile apps or online account management. Some savings accounts also provide ATM access, which can be convenient if you need to withdraw cash quickly.

4. Minimum Balance Requirements

Many savings accounts require a minimum balance to avoid fees or to earn a higher interest rate. Be sure to choose an account that aligns with your ability to maintain the required balance. If you cannot consistently keep the minimum balance, you might face penalties or reduced interest earnings.

5. Account Types and Features

There are several types of savings accounts, including regular savings accounts, high-yield savings accounts, money market accounts, and certificates of deposit (CDs). Determine which type best suits your financial goals and needs. For instance, a high-yield savings account may offer better interest rates, while a money market account might provide check-writing privileges and higher liquidity.

6. FDIC or NCUA Insurance

Ensure that your chosen savings account is insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA) if you are considering a credit union. This insurance protects your deposits up to $250,000 per depositor, providing peace of mind that your money is safe even if the bank fails.

7. Bank Reputation and Customer Service

Research the bank’s reputation and customer service quality. Reading customer reviews and checking ratings from financial institutions can provide insights into the bank’s reliability and how they treat their customers. A bank with excellent customer service can make managing your account easier and more pleasant.

8. Additional Benefits and Perks

Some savings accounts come with additional benefits, such as cash bonuses for new account holders, rewards programs, or discounts on other financial products. Consider these perks when choosing a savings account, as they can add value beyond the interest rate alone.

Conclusion

Choosing the right savings account involves considering several factors, including interest rates, fees, accessibility, minimum balance requirements, and the bank’s reputation. By evaluating these elements, you can select a savings account that aligns with your financial goals and maximizes your savings potential.