Creating a personal budget is a fundamental step towards achieving financial stability and reaching your financial goals. An effective budget helps you manage your income, control spending, and save for the future. Here’s how you can create a personal budget effectively:

1. Assess Your Income

Start by determining your total income. This includes your salary, any freelance work, rental income, or other sources of revenue. Understanding your monthly income is essential for setting realistic budgeting goals. SEO keywords like “how to calculate monthly income,” “determine total income,” and “assessing income for budgeting” will help improve search visibility.

2. Track Your Expenses

Tracking expenses is crucial to understand where your money goes each month. Categorize your expenses into fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment). This helps you identify areas where you can cut back. Keywords like “expense tracking tips,” “how to track spending,” and “budgeting for expenses” can enhance the article’s SEO performance.

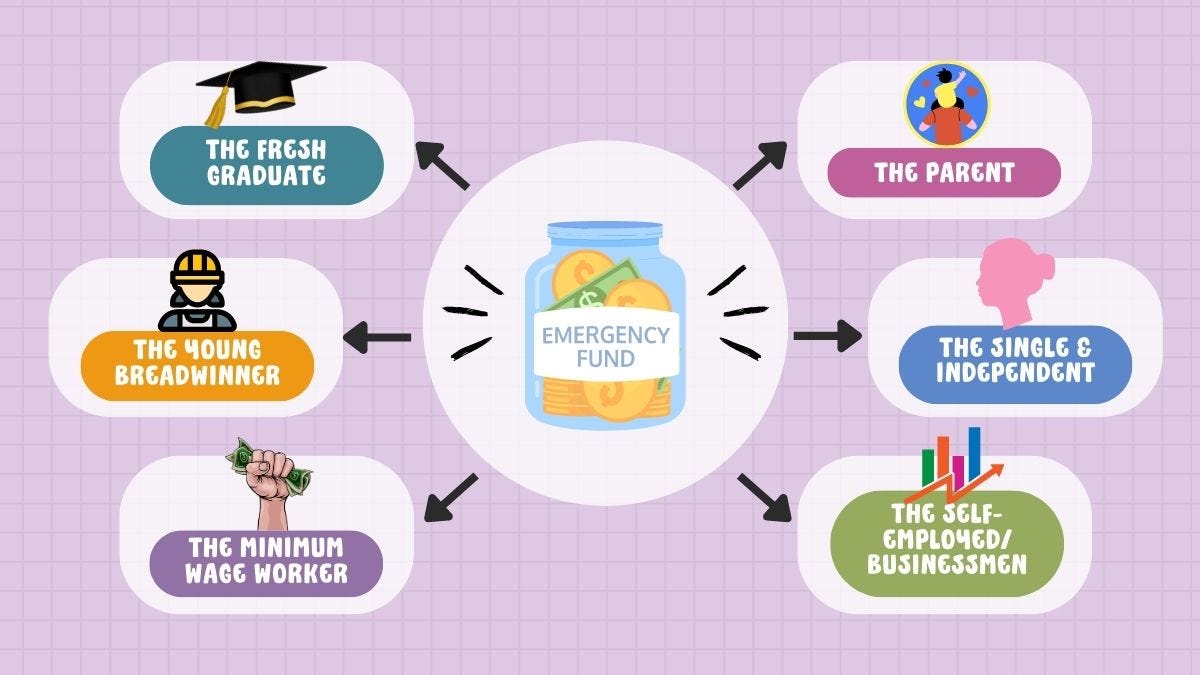

3. Set Financial Goals

Setting financial goals gives your budget a purpose. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, having clear goals will guide your budgeting decisions. Use SEO-friendly phrases such as “how to set financial goals,” “budgeting for savings,” and “financial goal-setting strategies” to optimize content.

4. Choose a Budgeting Method

There are various budgeting methods to choose from, such as the 50/30/20 rule, zero-based budgeting, or the envelope system. Select a method that aligns with your financial goals and lifestyle. Keywords like “best budgeting methods,” “50/30/20 rule,” and “zero-based budgeting” can attract readers searching for budgeting techniques.

5. Allocate Funds to Categories

Once you’ve chosen a budgeting method, allocate funds to each category, ensuring that your expenses don’t exceed your income. Prioritize essential expenses first, then allocate funds for savings and discretionary spending. SEO phrases like “how to allocate budget categories,” “budget allocation tips,” and “personal budget categories” can boost the article’s search ranking.

6. Monitor and Adjust Your Budget

Regularly monitor your budget to ensure you’re staying on track. Life changes, such as a new job or unexpected expenses, may require adjustments to your budget. SEO-friendly terms such as “how to adjust a budget,” “monitoring personal budget,” and “budget tracking strategies” will help improve search visibility.

7. Use Budgeting Tools and Apps

Budgeting tools and apps can simplify the budgeting process, offering features like automatic expense tracking, goal setting, and financial insights. Incorporating keywords like “best budgeting apps,” “online budgeting tools,” and “digital budgeting solutions” will optimize content for readers looking for tech solutions.

8. Review and Reflect

At the end of each month, review your budget to see how well you adhered to it. Reflect on areas where you did well and identify opportunities for improvement. Keywords like “monthly budget review,” “reflecting on budget performance,” and “budget evaluation tips” can improve the article’s SEO readability.

By following these steps, you can create a personal budget that is effective, manageable, and aligned with your financial goals. A well-planned budget is a powerful tool that can lead to financial success and peace of mind.