Creating a personal finance budget is an essential step to managing your money effectively, saving for future goals, and avoiding unnecessary debt. Here’s a step-by-step guide to help you create a personal finance budget:

1. Determine Your Income

List all sources of income: Include your salary, bonuses, freelance work, rental income, dividends, etc.

Calculate your total monthly income: Use your net income (after taxes and deductions).

2. Track Your Expenses

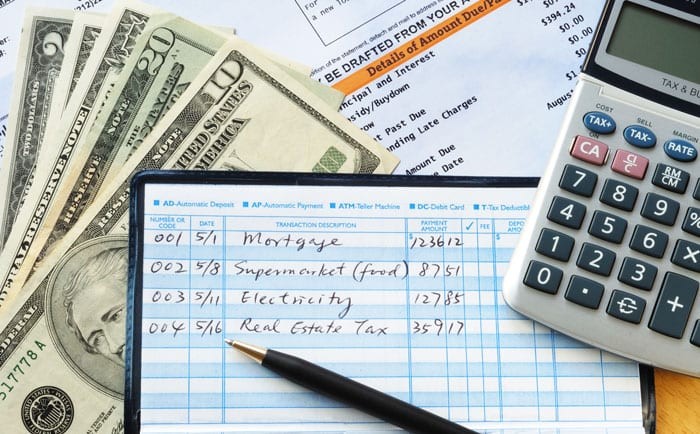

Categorize your expenses: Common categories include housing, utilities, transportation, groceries, dining out, entertainment, insurance, savings, and debt payments.

Track spending for at least one month: Use bank statements, receipts, and budgeting apps to get a comprehensive view of your spending habits.

3. Set Financial Goals

Short-term goals: Examples include building an emergency fund, paying off credit card debt, or saving for a vacation.

Long-term goals: Examples include saving for retirement, buying a home, or funding your children’s education.

SMART goals: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound.

4. Create a Plan

Allocate income to expenses: Start with fixed expenses (e.g., rent/mortgage, loan payments) and then allocate funds to variable expenses (e.g., groceries, entertainment).

Prioritize saving: Pay yourself first by allocating a portion of your income to savings and investments before spending on discretionary items.

Balance your budget: Ensure your total expenses do not exceed your total income. If they do, adjust your discretionary spending or find ways to increase your income.

5. Implement and Adjust

Use a budgeting tool: Consider using a spreadsheet, budgeting software, or mobile app to monitor your budget.

Review regularly: Check your budget monthly to ensure you’re on track and make adjustments as needed.

6. Tips for Successful Budgeting

Emergency fund: Aim to save 3-6 months’ worth of living expenses in a liquid, accessible account.

Reduce debt: Focus on paying off high-interest debt first, such as credit cards.

Cut unnecessary expenses: Identify and eliminate non-essential spending.

Automate savings: Set up automatic transfers to your savings and investment accounts.

Stay disciplined: Stick to your budget even when it’s challenging.