Decoding the Power of TAM Methodology

Why Total Addressable Market Drives Strategic Success

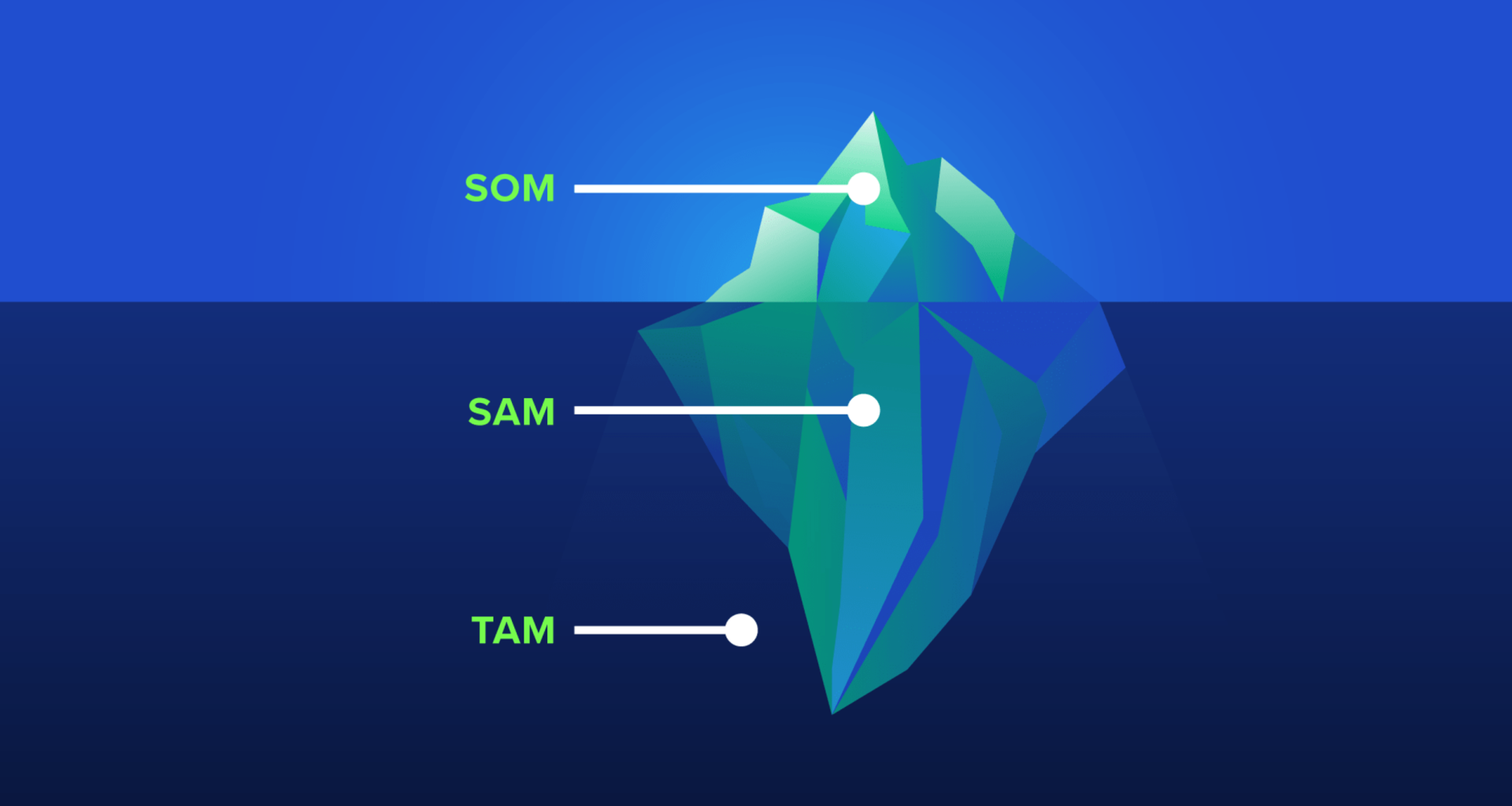

Total Addressable Market (TAM) methodology is a game-changer for businesses aiming to understand their full market potential. By calculating the maximum revenue opportunity for a product or service, TAM helps companies prioritize resources and set realistic goals. This data-driven approach empowers leaders to make informed decisions, aligning strategies with untapped opportunities. Mastering TAM analysis is essential for sustainable growth in competitive markets.

Breaking Down the TAM Calculation Process

How to Accurately Assess Your Market Size

Calculating TAM involves three key approaches: top-down, bottom-up, and value-theory methods. A top-down approach uses industry reports to estimate market size, while bottom-up builds from unit sales and pricing data. For example, a software company might analyze global demand for cloud solutions to define its TAM. By combining these methods, businesses gain a clear, actionable picture of their market potential.

Applying TAM to Real-World Business Scenarios

Why TAM Analysis Fuels Smarter Investments

Consider a startup launching a fitness app. Using TAM methodology, it identifies 100 million potential users globally, with an average subscription fee of $10 monthly, yielding a $12 billion TAM. This insight guides marketing budgets and investor pitches, highlighting scalability. By grounding strategies in TAM, companies attract funding and optimize expansion plans, ensuring every move maximizes impact.

Leveraging TAM for Long-Term Growth

How TAM Shapes Future-Ready Strategies

TAM methodology isn’t a one-time exercise; it evolves with market trends and innovation. Regularly updating TAM keeps businesses agile, helping them adapt to shifts like new technologies or consumer preferences. For instance, a renewable energy firm might expand its TAM as green policies grow. Staying proactive with TAM analysis positions companies to seize emerging opportunities and maintain a competitive edge.