In today’s fast-paced world, mastering personal finance management is crucial for achieving financial stability and success. “The Ultimate Finance Management Handbook” is your go-to guide for expert tips and strategies to manage your finances effectively. This comprehensive handbook covers everything from budgeting and saving to investing and retirement planning. Optimize your financial health with our top-notch advice and practical tools.

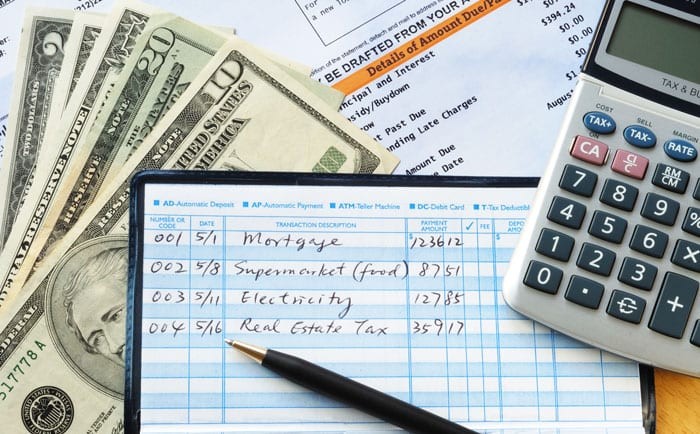

1. Budgeting Basics: Laying the Foundation

Effective finance management starts with a solid budget. Learn how to create a budget that aligns with your financial goals and helps you track your spending. Discover essential budgeting tools and techniques to stay on top of your finances.

2. Smart Saving Strategies

Saving money is a cornerstone of financial success. Our handbook offers smart saving strategies to help you build an emergency fund, save for big purchases, and achieve long-term financial goals. Learn about high-yield savings accounts, automatic savings plans, and more.

3. Debt Management: Overcoming Financial Burdens

Debt can be a significant obstacle to financial stability. Learn how to manage and pay off debt effectively with our proven strategies. From consolidating loans to negotiating with creditors, we provide the tools you need to become debt-free.

4. Investing Wisely: Building Wealth

Investing is key to building wealth over time. Our handbook covers various investment options, including stocks, bonds, mutual funds, and real estate. Understand the basics of investing, risk management, and how to create a diversified portfolio that suits your risk tolerance and financial goals.

5. Retirement Planning: Securing Your Future

Planning for retirement is essential for long-term financial security. Learn how to calculate your retirement needs, choose the right retirement accounts, and maximize your contributions. Our handbook provides insights into 401(k) plans, IRAs, and other retirement savings options.

6. Tax Optimization: Keeping More of Your Money

Taxes can significantly impact your finances. Discover strategies for tax optimization to minimize your tax liability and keep more of your hard-earned money. Learn about tax deductions, credits, and efficient tax planning techniques.

7. Insurance Essentials: Protecting Your Assets

Insurance is a critical component of a solid financial plan. Understand the different types of insurance, including health, life, auto, and homeowners insurance. Learn how to choose the right policies to protect your assets and ensure peace of mind.

8. Financial Planning for Life Events

Life events such as marriage, buying a home, or starting a family can significantly impact your finances. Our handbook guides you through financial planning for major life events, ensuring you are prepared for the financial changes they bring.

9. Leveraging Technology for Financial Management

Technology can simplify financial management. Explore the best financial apps, tools, and software to help you manage your budget, track expenses, and invest wisely. Stay updated with the latest financial technology trends to enhance your financial health.

10. Creating a Sustainable Financial Future

Achieving long-term financial success requires a sustainable approach. Learn how to set realistic financial goals, monitor your progress, and adjust your strategies as needed. Our handbook emphasizes the importance of continuous learning and adaptation in finance management.

Conclusion

“The Ultimate Finance Management Handbook” is your comprehensive guide to mastering personal finance. With expert tips, practical tools, and strategic advice, you can take control of your finances, achieve your financial goals, and build a secure financial future. Start your journey to financial success today!