Insights from the World’s Most Successful Investors

Investing is an art that combines strategy, patience, and a deep understanding of market dynamics. The stories of the most successful investors offer valuable lessons for anyone looking to navigate the financial landscape. Here are the top five investors whose strategies and philosophies have shaped the investment world.

1. Warren Buffett: The Oracle of Omaha

Net Worth: $147 billion

Investment Approach: Value InvestingWarren Buffett, often referred to as the Oracle of Omaha, is renowned for his disciplined value investing strategy. He emphasizes buying high-quality companies at fair prices rather than chasing trends. Buffett’s success with Berkshire Hathaway has made him a household name, with a staggering return on investment over decades.

Lessons from Buffett:

- Patience is Key: Buffett’s long-term investment horizon teaches us the importance of patience in achieving substantial returns.

- Focus on Quality: Investing in fundamentally strong companies can lead to sustainable wealth.

2. Peter Lynch: The Growth Guru

Net Worth: Estimated at $450 million

Investment Approach: Growth and Value InvestingPeter Lynch is best known for managing the Fidelity Magellan Fund, where he achieved an average annual return of 29.2% from 1977 to 1990. His philosophy encourages investors to “buy what you know,” suggesting that personal experience can guide investment choices.

Lessons from Lynch:

- Invest in Familiarity: Understanding a product or service can provide insights into potential investment success.

- Stay Engaged: Active involvement in your investments can yield better results than passively following trends.

3. Bill Ackman: The Activist Investor

Net Worth: $9.1 billion

Investment Approach: Activist InvestingBill Ackman, founder of Pershing Square Capital Management, is known for his bold investment strategies and public advocacy for corporate changes. His notable successes include significant returns from investments in companies like General Growth Properties.

Lessons from Ackman:

- Be Bold: Taking calculated risks can lead to substantial rewards.

- Engage with Management: Advocating for change within companies can unlock hidden value.

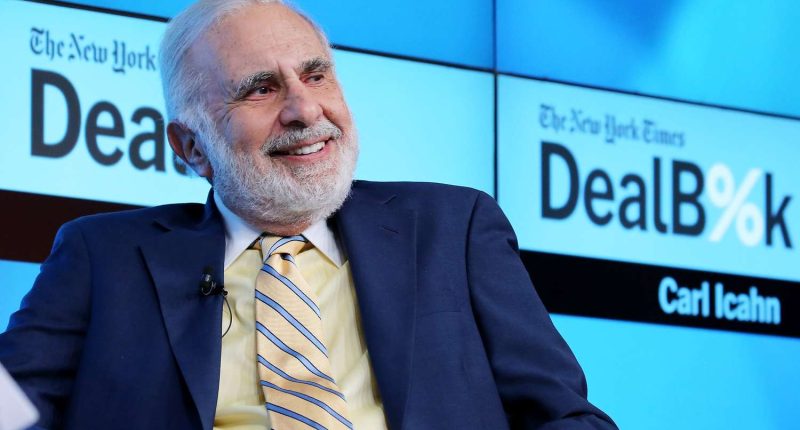

4. Carl Icahn: The Corporate Raider

Net Worth: $4.8 billion

Investment Approach: Activist InvestingCarl Icahn made a name for himself as one of the original corporate raiders, using his influence as a shareholder to push for operational improvements within companies. His aggressive approach has led to significant gains and transformations in various firms.

Lessons from Icahn:

- Use Influence Wisely: Shareholder activism can drive positive change and enhance shareholder value.

- Adapt Strategies: Flexibility in approach can be crucial for navigating different market conditions.

5. Jim Simons: The Quantitative Pioneer

Net Worth: Estimated at $23 billion

Investment Approach: Quantitative InvestingJim Simons, founder of Renaissance Technologies, revolutionized investing through quantitative analysis and algorithmic trading. His firm is known for its impressive returns, utilizing complex mathematical models to make informed investment decisions.

Lessons from Simons:

- Embrace Technology: Leveraging data and technology can provide a competitive edge in investing.

- Stay Analytical: A systematic approach helps mitigate emotional decision-making in investing.

Learning from Investment Legends

The stories of these five successful investors illustrate diverse strategies and philosophies that have led to remarkable achievements in the financial world. By studying their approaches, we can glean important lessons about patience, engagement, risk-taking, and the power of technology in investing. Whether you’re a novice or an experienced investor, these insights can help guide your journey toward financial success.