Bitcoin mining is the backbone of the world’s largest cryptocurrency network, serving as both a transaction verification mechanism and a means of introducing new coins into circulation. This article delves into the intricacies of Bitcoin mining, exploring how it works and what it takes to make it a profitable venture in today’s competitive landscape.

The Essence of Bitcoin Mining

Powering the Blockchain

Bitcoin mining is the process that keeps the Bitcoin network running by creating new blocks on the blockchain and verifying transactions. Miners use specialized hardware to solve complex mathematical puzzles, competing to add new blocks to the chain and earn rewards in the form of newly minted bitcoins.

The Mining Process Explained

From Transactions to Blocks

The mining process begins with collecting pending transactions from the mempool to form a new block. Miners then calculate the Merkle root, a single hash representing all transactions in the block. The most computationally intensive step involves solving the Proof of Work (PoW) puzzle by finding a nonce that, when added to the block and hashed, produces a result meeting the network’s difficulty target.

Hardware and Energy Requirements

The Tools of the Trade

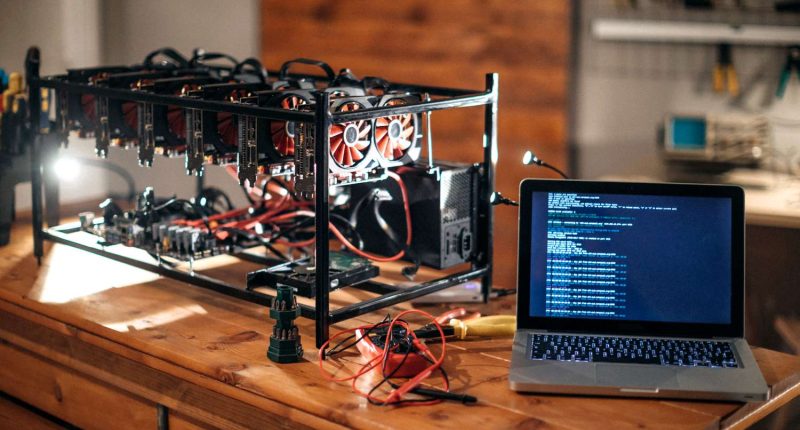

Successful Bitcoin mining requires two key components: mining hardware and energy. Miners utilize specialized computers called nodes to contribute computing power to the network. As the difficulty of mining increases, more powerful and energy-efficient hardware becomes necessary to remain competitive.

Mining Rewards and Incentives

Block Rewards and Transaction Fees

Bitcoin miners are incentivized through two primary mechanisms: block rewards and transaction fees. Currently, the block reward stands at 3.125 bitcoins per block, with transaction fees providing an additional income stream. As the block reward diminishes over time due to Bitcoin’s halving events, transaction fees are expected to become the primary incentive for miners.

Challenges and Considerations

Navigating the Mining Landscape

Bitcoin mining faces several challenges, including high energy consumption, regulatory concerns, and increasing competition. Successful miners must choose energy-efficient hardware, secure low-cost electricity, implement effective cooling systems, and stay informed about technological advancements and market trends.

Mining Pools and Collaboration

Strength in Numbers

Many miners opt to join mining pools, combining their computational resources to increase the chances of solving blocks and earning rewards. This collaborative approach allows individual miners to receive more consistent, albeit smaller, payouts compared to solo mining.

The Future of Bitcoin Mining

Adapting to a Changing Landscape

As the Bitcoin network evolves, miners must adapt to remain profitable. This includes embracing more energy-efficient technologies, exploring alternative energy sources, and potentially diversifying into other cryptocurrencies. The long-term sustainability of mining will depend on the balance between network security, energy consumption, and economic incentives.

Bitcoin mining plays a crucial role in maintaining the security and decentralization of the world’s most valuable cryptocurrency network. While it presents significant challenges, those who can navigate its complexities and adapt to changing conditions may find it to be a rewarding venture in the digital age.