The Foundation of Investor Appeal

Visionary Leadership and Team Dynamics

Investors seek startups with visionary leadership that can set a clear direction for the company. A founder’s ability to articulate a compelling strategy while balancing long-term thinking with pragmatism is crucial. Equally important is a skilled and aligned team that complements the founding members. Cognitive diversity within the team, combining technical, business, and industry expertise, is highly valued by investors.

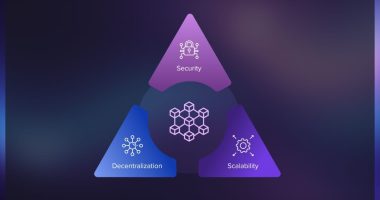

Market Potential and Scalability

Tapping into Growth Opportunities

Investors look for startups that demonstrate strong scalability signals and sustained incremental growth. This includes evidence of product-market fit, such as inbound customer interest and the ability to meet demand. Consecutive reductions in sales cycles and ease of high-profile hires are also positive indicators. Investors analyze monthly recurring revenue, net revenue retention rate, and customer lifetime value to assess predictability and scalability.

Customer Insights and Unit Economics

Building a Sustainable Business Model

A holistic understanding of customer insights is crucial for investor interest. Startups should go beyond vanity metrics and focus on user behavior analytics and real-time feedback. Improving unit economics, including gross margins by product line and customer cohorts over time, indicates sustainability. Startups need to demonstrate an understanding of ideal customer pricing and potential margins.

Traction and Growth Indicators

Proving Market Validation

Investors focus on a startup’s track record when evaluating traction. This includes not just revenues, but also customer retention, reorder rates, partner satisfaction, and market potential. The specific growth indicators that investors look for may vary depending on the startup’s stage. For early-stage startups, investors typically assess Total Addressable Market (TAM) potential and validate risk assumptions.

Problem-Solving and Uniqueness

Addressing Real-World Challenges

Investors are drawn to startups that offer original solutions to current, real-world problems. The presence of advanced technology in the solution can increase the likelihood of success. A Unique Selling Proposition (USP) is essential, whether it’s found directly in the product or in the business model.

Feasibility and Scalability

From Prototype to Global Expansion

While a prototype or beta version is important, investors also verify the feasibility of scaling the product or service. They assess whether the cost of production can be reduced at scale and if the business model allows for rapid growth and potential global expansion.

Market Analysis and Competition

Understanding the Competitive Landscape

Investors evaluate the market potential and competitive landscape to gauge demand, identify real competition, and understand barriers to entry. They assess how long a product might take to establish itself in the market and its potential for rapid expansion.

By focusing on these key areas, startups can align themselves with investor expectations and increase their chances of securing funding. Remember, while these criteria are important, personal chemistry between founders and investors also plays a significant role in investment decisions.