Budgeting is a crucial financial tool that helps individuals and businesses manage their income, expenses, and savings effectively. Implementing best practices in budgeting can lead to financial stability and long-term success. Here are some of the best practices for budgeting that you can follow:

1. Set Clear Financial Goals

Short-Term and Long-Term Goals: Start by defining your financial goals. These can range from short-term objectives like saving for a vacation to long-term goals such as retirement planning or buying a home. Clear goals provide direction and motivation for sticking to your budget.

Prioritize: Identify which goals are most important and focus on them. Prioritizing helps in allocating resources effectively.

2. Track Your Income and Expenses

Detailed Tracking: Keep a detailed record of all your income sources and expenses. This includes fixed expenses like rent or mortgage, utilities, and variable costs such as groceries and entertainment.

Use Tools: Utilize budgeting apps or spreadsheets to make tracking easier and more accurate. These tools can also help in categorizing expenses, making it easier to identify areas where you can cut costs.

3. Create a Realistic Budget

Base It on Actual Data: Use your tracked income and expenses data to create a realistic budget. Ensure that your budget reflects your actual spending habits and income.

Flexibility: Allow some flexibility in your budget to accommodate unexpected expenses. This prevents overspending and keeps your budget manageable.

4. Implement the 50/30/20 Rule

50% Needs: Allocate 50% of your income to essential needs, such as housing, utilities, and groceries.

30% Wants: Dedicate 30% of your income to non-essential expenses like dining out, hobbies, and entertainment.

20% Savings and Debt Repayment: Use 20% of your income for savings and paying off debts. This rule helps in maintaining a balanced budget that covers all financial aspects.

5. Regularly Review and Adjust Your Budget

Monthly Reviews: Conduct monthly reviews of your budget to compare your actual spending with your budgeted amounts. Identify any discrepancies and adjust your budget accordingly.

Adjust for Life Changes: Life changes such as a new job, a raise, or unexpected expenses may require you to adjust your budget. Regularly reviewing your budget ensures it remains relevant and effective.

6. Build an Emergency Fund

Essential for Stability: An emergency fund is a financial safety net that covers unexpected expenses like medical bills or car repairs. Aim to save at least three to six months’ worth of living expenses.

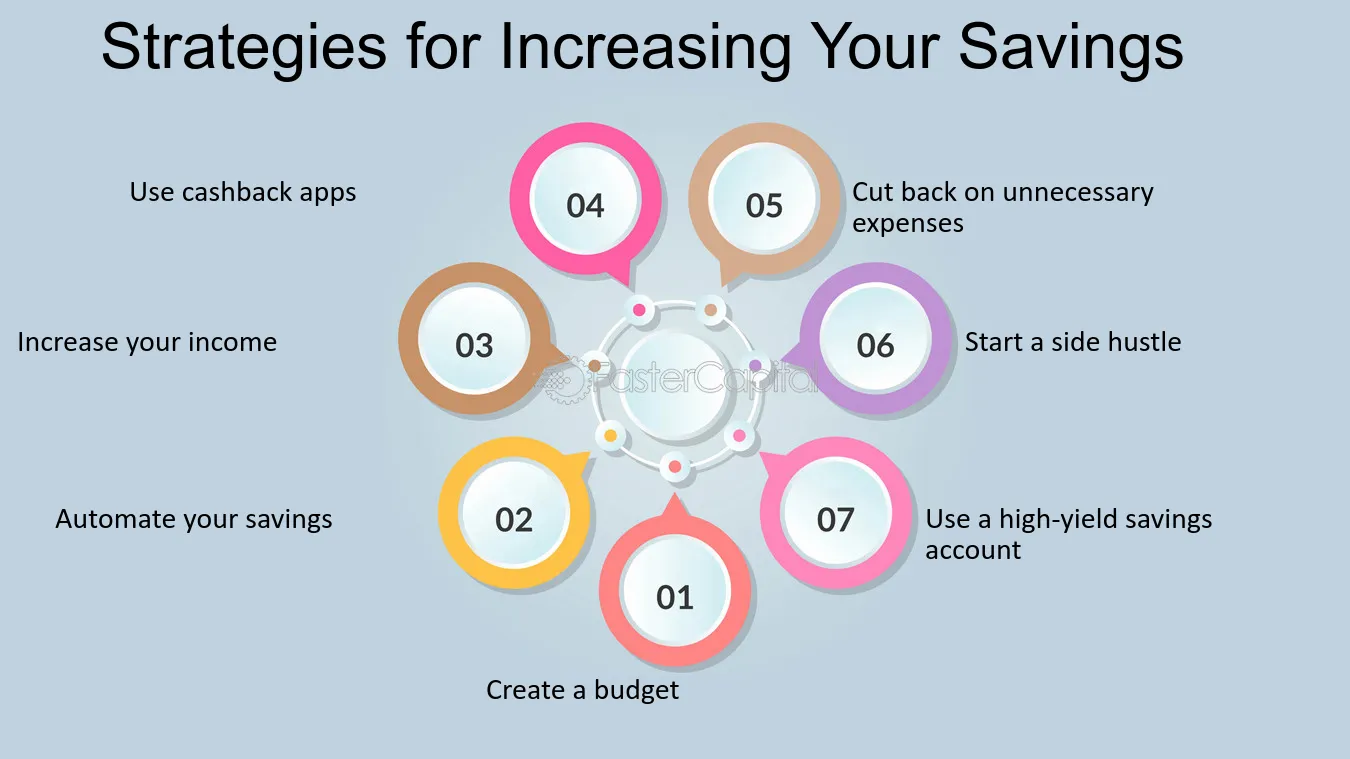

Automate Savings: Set up automatic transfers to your emergency fund to ensure consistent contributions.

7. Limit Debt and Manage It Wisely

Avoid Unnecessary Debt: Be cautious about taking on new debt, especially for non-essential items. High-interest debt can quickly spiral out of control.

Pay Off Existing Debt: Focus on paying off high-interest debt first, such as credit card balances. This reduces the amount of interest you pay over time and frees up money for other financial goals.

8. Involve Your Family

Collaborative Budgeting: If you’re budgeting for a household, involve your family members in the process. This ensures everyone is on the same page and committed to the budget.

Educational Opportunity: Teach children the importance of budgeting and financial management. This can instill good financial habits early on.

Conclusion

By following these best practices for budgeting, you can take control of your finances and work towards achieving your financial goals. Remember that budgeting is an ongoing process that requires regular review and adjustments. Stay committed, and you’ll reap the benefits of financial stability and security.