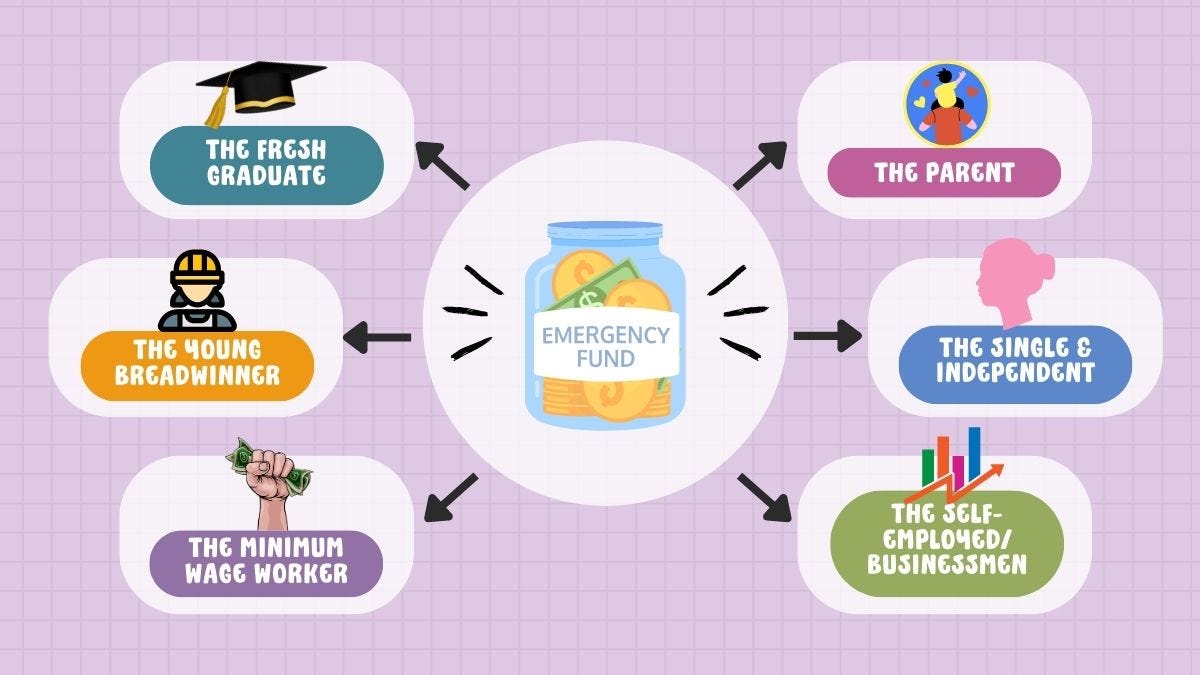

Steps to Build an Emergency Fund Successfully

Building an emergency fund is a crucial step towards achieving financial security. An emergency fund acts as a financial safety net, providing you with the resources to handle unexpected expenses without resorting to debt. Whether it’s a medical emergency, car…

How to Create a Personal Budget Effectively

Creating a personal budget is a fundamental step towards achieving financial stability and reaching your financial goals. An effective budget helps you manage your income, control spending, and save for the future. Here’s how you can create a personal budget…

The Future of Personal Finance: Trends to Watch

Personal finance is evolving rapidly, driven by technological advancements, changing consumer behavior, and a shifting economic landscape. As we move forward, staying ahead of emerging trends in personal finance can help individuals make informed decisions, optimize their financial strategies, and…

Understanding the Psychology of Money Management

Money management is more than just numbers; it’s deeply intertwined with human psychology. Understanding the psychology of money management is crucial for making informed financial decisions, improving your relationship with money, and achieving long-term financial success. By recognizing the emotional…

Navigating Personal Finance in a Digital Age

In today’s rapidly evolving digital landscape, managing personal finances has become more accessible and efficient than ever before. The integration of technology into financial practices offers a wealth of tools and resources to help individuals take control of their financial…

The Journey to Financial Independence: Key Steps

Achieving financial independence is a goal many aspire to but few truly understand. Financial independence means having enough wealth to cover your living expenses for life without needing to work actively. This goal provides security, freedom, and the ability to…

Mastering Personal Finance: A Comprehensive Overview

Mastering personal finance is essential for achieving financial stability and building long-term wealth. By understanding and implementing key personal finance principles, you can effectively manage your money, reduce financial stress, and secure your financial future. This comprehensive overview covers essential…

What Are the Best Practices for Managing Debt?

Effectively managing debt is essential for maintaining financial health and achieving long-term financial goals. By following best practices for debt management, you can reduce financial stress, improve your credit score, and work towards a debt-free future. Here are some of…

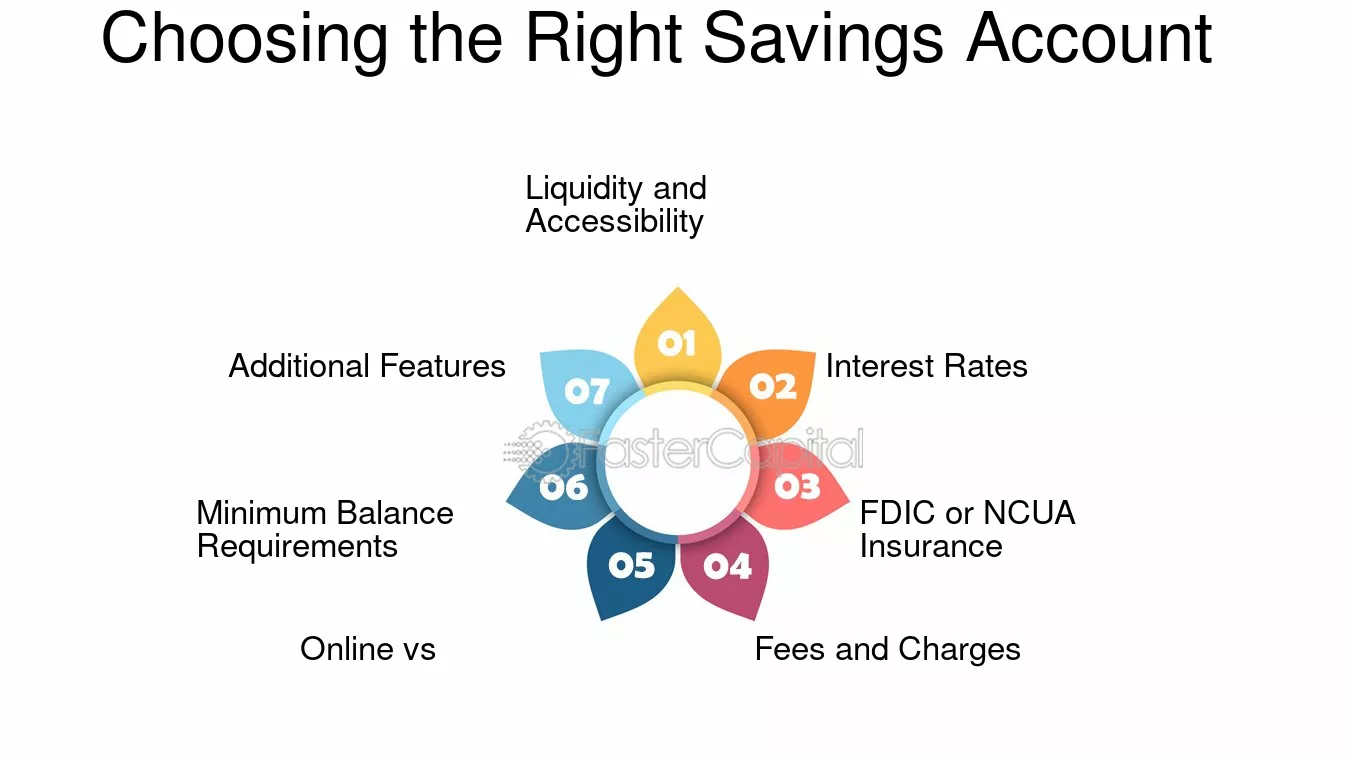

How Do I Choose the Right Savings Account?

Choosing the right savings account is an essential step in managing your personal finances effectively. A well-selected savings account not only keeps your money safe but also helps it grow through interest. With so many options available, understanding how to…

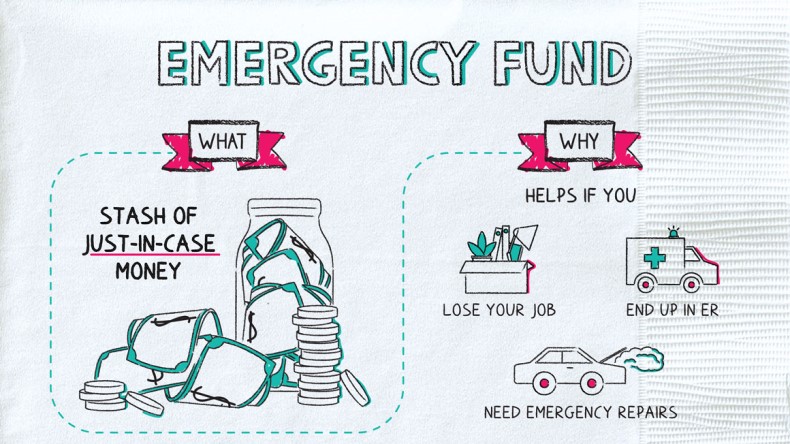

What Is the Importance of an Emergency Fund?

An emergency fund is a financial safety net designed to cover unexpected expenses and financial emergencies. It is one of the most crucial aspects of personal finance management, providing peace of mind and financial security in times of crisis. Let’s…