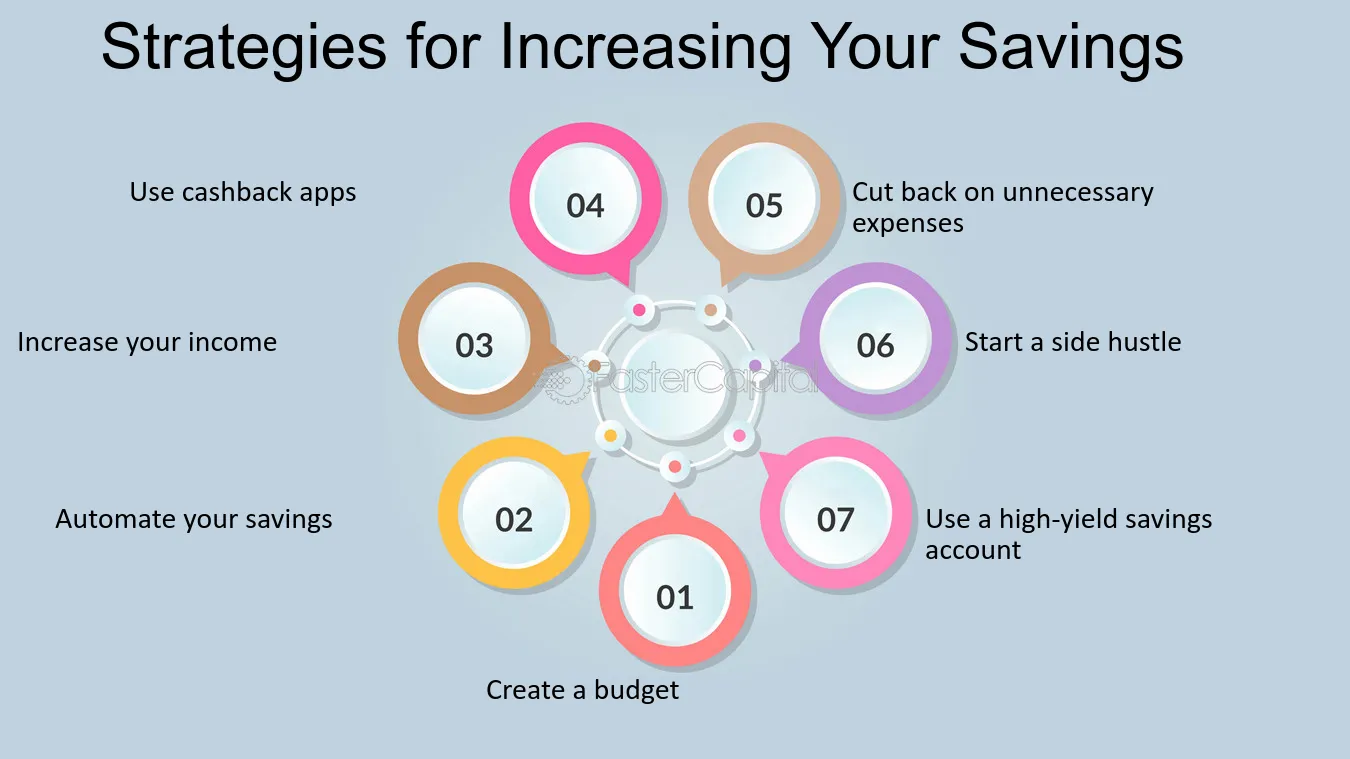

Effective money management is crucial for achieving financial stability and long-term success. Whether you’re looking to save more, invest wisely, or simply make better financial decisions, these seven strategies can help you manage your money more effectively.

1. Create a Detailed Budget

Creating a detailed budget is the foundation of effective money management. Track your income and expenses to understand where your money is going. Use this information to allocate funds for essentials like housing, food, and transportation, while also setting aside money for savings and investments. A well-structured budget helps you avoid overspending and ensures you live within your means.

2. Set Clear Financial Goals

Setting clear financial goals gives you a roadmap for your financial journey. Whether it’s saving for a down payment on a house, building an emergency fund, or planning for retirement, having specific goals helps you stay focused and motivated. Break down your goals into smaller, actionable steps to make them more achievable.

3. Build an Emergency Fund

An emergency fund is a critical component of effective money management. Aim to save three to six months’ worth of living expenses in a readily accessible account. This fund acts as a financial safety net, protecting you from unexpected expenses like medical bills or car repairs without derailing your financial plans.

4. Reduce and Manage Debt

Managing and reducing debt is essential for financial health. Start by paying off high-interest debt, such as credit card balances, as quickly as possible. Consider consolidating your debts to lower interest rates and simplify payments. Reducing debt frees up more of your income for savings and investments.

5. Invest Wisely

Investing is a key strategy for growing your wealth over time. Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to minimize risk. Consider working with a financial advisor to create an investment plan tailored to your goals and risk tolerance.

6. Monitor Your Credit Score

Your credit score plays a significant role in your financial life, affecting your ability to get loans, credit cards, and even housing. Regularly monitor your credit score and take steps to improve it, such as paying bills on time, reducing credit card balances, and avoiding new debt. A good credit score can save you money through lower interest rates.

7. Review and Adjust Your Financial Plan Regularly

Financial management is not a one-time task but an ongoing process. Regularly review your budget, goals, and investments to ensure they align with your current financial situation and objectives. Adjust your financial plan as needed to stay on track and accommodate changes in your life, such as a new job, marriage, or the birth of a child.

By implementing these seven strategies, you can take control of your finances, reduce stress, and work towards a secure financial future. Effective money management requires discipline and regular attention, but the rewards are well worth the effort.