Effective finance management is crucial for achieving financial stability and success. Here are ten essential finance management tips to help you take control of your finances, optimized for SEO readability with targeted keywords.

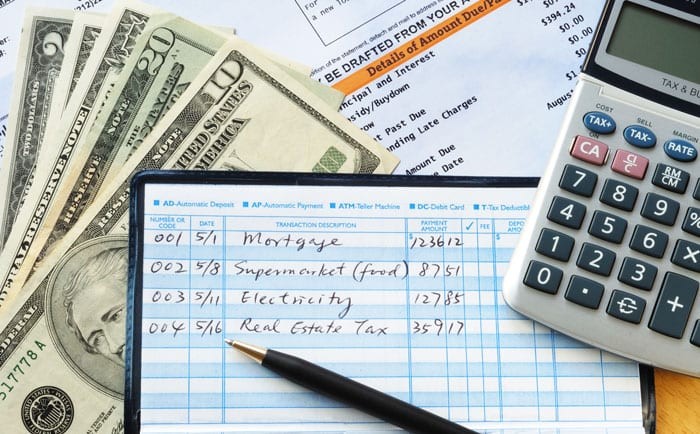

1. Create a Budget

Creating a budget is the foundation of good finance management. Track your income and expenses to understand where your money is going and identify areas where you can cut back.

2. Track Your Expenses

Keep a detailed record of all your expenditures. This will help you identify unnecessary spending and make adjustments to stay within your budget.

3. Build an Emergency Fund

An emergency fund is essential for unexpected expenses. Aim to save at least three to six months’ worth of living expenses to ensure you are prepared for any financial emergencies.

4. Reduce Debt

Prioritize paying off high-interest debt such as credit card balances. Reducing debt will improve your financial health and increase your savings potential.

5. Save for Retirement

Start saving for retirement as early as possible. Utilize retirement accounts such as 401(k)s or IRAs to take advantage of compound interest and employer matching contributions.

6. Invest Wisely

Diversify your investments to minimize risk and maximize returns. Consider consulting a financial advisor to develop a strategy that aligns with your financial goals.

7. Monitor Your Credit Score

Regularly check your credit score and report to ensure accuracy. A good credit score is essential for securing loans and favorable interest rates.

8. Cut Unnecessary Expenses

Identify and eliminate unnecessary expenses from your budget. This could include dining out less, canceling unused subscriptions, or finding more cost-effective alternatives.

9. Automate Savings

Set up automatic transfers to your savings account to ensure consistent saving. This can help you build your savings without the temptation to spend.

10. Review and Adjust Regularly

Regularly review your financial situation and adjust your budget and savings goals as needed. Staying proactive and adaptable is key to effective finance management.