Understanding Private Credit’s Expanding Landscape

Private credit has emerged as a critical player in the financial ecosystem, particularly as traditional lending avenues face increased scrutiny and regulatory challenges. As we look ahead to 2025, the private credit market is projected to grow significantly, potentially reaching $2.8 trillion from approximately $1.5 trillion at the start of 2024. This growth underscores the evolving role of private credit as an attractive alternative for institutional investors seeking robust returns.

Key Trends Shaping Private Credit in 2025

Rising Demand for Risk-Adjusted Returns

One of the most compelling aspects of private credit is its ability to deliver risk-adjusted returns that often outperform traditional asset classes like private equity. With interest rates expected to remain elevated longer than anticipated, private credit offers an attractive proposition for institutional investors. The potential for enhanced returns is particularly evident in direct lending, where borrowers are likely to benefit from lower interest rates and a favorable economic environment.

Regulatory Changes and Market Dynamics

The regulatory landscape surrounding private credit is also evolving. Increased scrutiny on traditional lenders has created opportunities for non-bank lenders to fill the gap left by banks scaling back their involvement. As these dynamics unfold, private credit fund managers must prioritize transparency and risk management to navigate regulatory challenges effectively.

Technological Innovations in Private Credit Administration

Leveraging AI and Machine Learning

Technological advancements, particularly in loan administration, are set to revolutionize the private credit sector. The integration of artificial intelligence (AI) and machine learning will streamline operations, enhance risk assessment, and improve overall efficiency. As these technologies become more prevalent, they will play a crucial role in shaping the future of private credit.

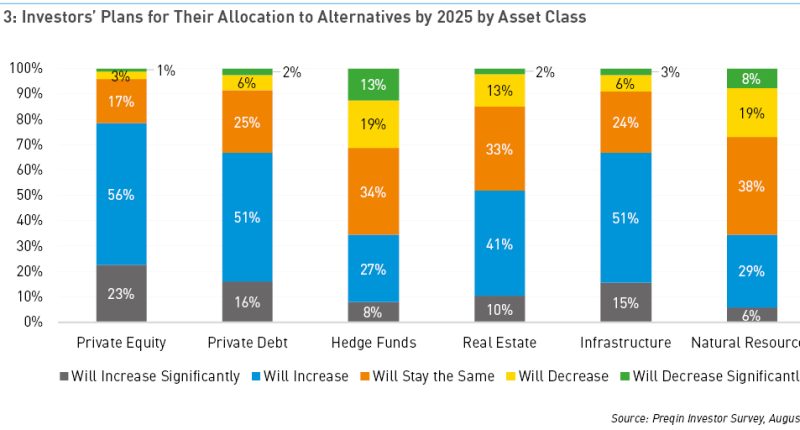

Expanding into New Asset Classes

Private credit is not only growing in size but also diversifying its offerings. The sector is expected to expand into new asset classes, including asset-based lending and hybrid capital solutions for growth companies. This diversification will enable private credit to cater to a broader range of borrower needs while enhancing investment opportunities for institutional players.

The Future of Private Credit

As we approach 2025, the role of private credit will continue to evolve, driven by changing market conditions and technological advancements. Investors must stay informed about these trends to capitalize on the opportunities presented by this dynamic asset class. With its potential for strong returns and expanding market reach, private credit is poised to play a pivotal role in the financial landscape of the coming years.